Menu

Roof Damage

Have you experienced roof damage? Central Florida Property Claims is available for you 24/7, with an expert team of Central Florida Public Adjusters ready to help fix any problem from day one - we represent and manage insurance claims for commercial properties too!

Roof Damage

Have you experienced roof damage? Central Florida Property Claims is available for you 24/7, with an expert team of Central Florida Public Adjusters ready to help fix any problem from day one - we represent and manage insurance claims for commercial properties too!

Every year hurricanes, tropical storms, hailstorms, and afternoon thunderstorms deliver millions of dollars in damage to commercial and residential properties, making roof claims some of the most common insurance claims in Florida. Roof damage can affect the water sheading ability of the roof and can drastically shorten the service life of the roof. Steps need to be taken to prevent your property from further loss, and that is why it is important to be aware of damage done to your roof as soon as possible.

Every year hurricanes, tropical storms, hailstorms, and afternoon thunderstorms deliver millions of dollars in damage to commercial and residential properties, making roof claims some of the most common insurance claims in Florida. Roof damage can affect the water sheading ability of the roof and can drastically shorten the service life of the roof. Steps need to be taken to prevent your property from further loss, and that is why it is important to be aware of damage done to your roof as soon as possible.

What Causes Roof Damage and How to Find Roof damage?

Roof damage can be found in a variety of ways based on the type of roof. Shingle roofs are highly susceptible to wind and hail damage. Wind damage on a shingle roof will be represented by missing shingles, creased shingles and roof damage created by flying debris. This damage is caused by the wind forcing the shingle up and down repeatedly. Eventually a crease is formed on the top of the shingle or the shingle is completely removed. It is important to know the difference between wind damage and other non-storm related damage such as thermal expansion which usually causes the lower left corners of shingles to become unbound. Our skilled public adjusters know the difference and will document all your storm related wind damage.

Hailstorms will cause roof damage to your shingle roof by causing a puncture to the shingle, reducing the service life. When looking for hail damage, it is important to look at other roof components such as roof vents. This will help determine the size of the hail. Just because there are hail marks, that does not mean there is roof damage. The threshold for hail to cause damage to shingle roofs is roughly 1 ¼ inch.

Concreate tile and slate roofs are highly resistant to wind damage, but high enough winds can displace tiles leaving the underlayment susceptible to water entering the home. Tile roofs will experience damage from hailstorms which can cause cracking of tiles which leads to future roof leaks. Given the natural durability of tile and slate roofs, the threshold for the size of hail required to cause roof damage is roughly 1 ¾ inch. Factors such as the angle of the hail fall, and impact areas can affect the degree of damage done.

How can Central Florida Property Claims Help You with Your Roof Damage?

Our experienced public adjusters stand out in the industry because we are Haag Engineering Roof Inspector Certified. With our knowledge and experience, we will first complete a detailed inspection of your roof and document all damage found on your residential or commercial property. Once we have completed our investigation, we will create a repair estimate on your behalf.

The next step is meeting with your insurance company’s adjuster so they can conduct their own inspection. Once they have completed their inspection, we will begin negotiating a payment from your insurance company. Our goal is to settle your roof claim for the maximum amount of money in the shortest amount of time.

Types of residential and commercial damage we manage:

Types of residential and commercial damage we manage:

Frequently asked questions

What is a public adjuster?

A public adjuster is a licensed insurance processional that represents policyholders and advocated for their best interest. A public adjuster ensures the policyholder is paid the maximum amount of money possible and the insurance company makes the payment in the shortest amount of time. Whether it is a brand-new claim or an old claim that was denied or underpaid, a public adjuster will manage the claim from start to finish.

Why do I need a public adjuster?

Insurance claims are detailed and complex. To ensure you are paid the maximum dollar amount, our public adjusters will fulfill all your duties outlined in your policy, prepare all the required documents, create a detailed repair estimate, consult with expert contractors, manage all correspondence with your insurance company and much more! A study done by The Office Program Policy Analysis and Government Accountability (OPPAGA) found that policyholders that used a public adjuster received 747% more on their insurance claim than policyholder who filed on their own.

What does it cost to start?

Our fee for service is based solely on us recovering money for your claim. We do not require any money upfront, and we only get paid if you get paid! The first step to getting you paid is to give us a call today so we can schedule a time to meet with on of our public adjusters.

What are the next steps?

Free initial consultation which includes an inspection, damage assessment and policy review.

We will then schedule and attend an inspection with your insurance company’s adjuster.

Once our reports are complete, we will start negotiations to get your claim settled.

We are here to make this process simple and hassle free for you!

What are the next steps?

Free initial consultation which includes an inspection, damage assessment and policy review.

We will then schedule and attend an inspection with your insurance company’s adjuster.

Once our reports are complete, we will start negotiations to get your claim settled.

We are here to make this process simple and hassle free for you!

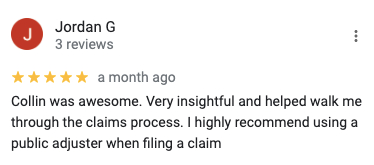

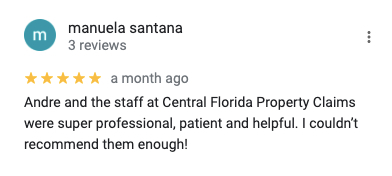

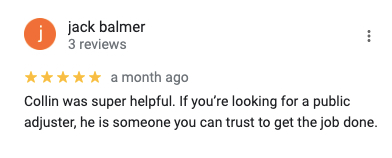

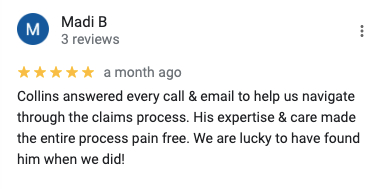

What customers say About Us

What Customers say About Us

Get A FREE Inspection Today

Get A FREE Inspection Today

©2023 by Central Florida Property Claims. Andre Kratt Lic. #W636283

©2023 by Central Florida Property Claims.

Andre Kratt Lic. #W636283