Menu

Hurricane Damage

Have you experienced hurricane damage? Central Florida Property Claims is available for you 24/7, with an expert team of Central Florida Public Adjusters ready to help fix any problem from day one - we represent and manage insurance claims for commercial properties too!

Hurricane Damage

Have you experienced hurricane damage? Central Florida Property Claims is available for you 24/7, with an expert team of Central Florida Public Adjusters ready to help fix any problem from day one - we represent and manage insurance claims for commercial properties too!

Hurricanes leave behind indiscriminate destruction whenever they come ashore. The intense rains, howling winds, and storm surges affect all homes and commercial properties. While you can perform mitigation, that does not mean your home will pass through the storm unscathed. The time after a hurricane is difficult for you and your family and adding worry about insurance claims for hurricane damage is more stressful than other scenarios. Unfortunately, insurance companies can be impossible to reach during this time too.

Central Florida Property Claims makes filing a claim for hurricane damage easier. CFL public adjusters are on your side, and each is familiar with the intricacies of insurance companies. The team ensures your insurance company pays what you need to recover without the hassle of handling your own claim.

Hurricanes leave behind indiscriminate destruction whenever they come ashore. The intense rains, howling winds, and storm surges affect all homes and commercial properties. While you can perform mitigation, that does not mean your home will pass through the storm unscathed. The time after a hurricane is difficult for you and your family and adding worry about insurance claims for hurricane damage is more stressful than other scenarios. Unfortunately, insurance companies can be impossible to reach during this time too.

Central Florida Property Claims makes filing a claim for hurricane damage easier. CFL public adjusters are on your side, and each is familiar with the intricacies of insurance companies. The team ensures your insurance company pays what you need to recover without the hassle of handling your own claim.

Common Types of Hurricane Damage

Hurricanes are devastating, and it only takes one intense storm to damage your Orlando, Tampa, Daytona, or The Villages home. Insurance claims after hurricanes must often cover multiple types of damage and areas of your home.

Examples of Hurricane Damage:

Flooding

Water damage from above ground

Debris strikes

Damage to motor vehicles, RVs, and boats

Damage to commercial properties, including vacation rentals

Business disruption

Wind damage

While you can prepare and try to minimize damage, almost no property is completely hurricane-proof in Central Florida. In addition, while you’re living in the aftermath of a hurricane, gathering evidence for your insurance claim can easily end up low on the priority list. Even if you do gather evidence of hurricane damage, filing a claim can prove challenging. You may have a couple of types of insurance, such as homeowner’s and flood. Filing the proper damage with the right insurance company is only the first step to the insurance payout you need to rebuild your life.

Insurance Company Tricks After a Hurricane

Insurance companies want to minimize how much they spend after a hurricane while keeping you as a customer. After all, your monthly insurance premium is how they make money. Insurance companies use many tricks to avoid sending you a payout for hurricane damage. An insurance professional on your side can help you navigate these insurance obstacles.

A standard tactic after a hurricane is informing you that all or part of the damage you submitted is not covered in your policy. Often, the insurance company will insist that it must be from a non-covered cause and that you must submit it to another type of insurance like flood. It’s a complex process to prove that the insurance company is wrong.

Insures sometimes take the tactic a step further and require that you prove how the damage occurred. Without your own expert, this task is difficult, especially if you have a large amount of hurricane damage. It’s another step you must arrange to overcome, and sometimes it’s impossible in the devastation of hurricane aftermath. Hurricanes specifically also result in a large number of insurance claims. The company may decide not to staff appropriately and move your claim as slow as legally possible. The delay in payout may leave you on the hook for necessary repairs to create a livable space for your family. Your insurer may also force you to prove the value of the repairs or your belongings before they will settle the claim. This lengthy and time-consuming process may result in you paying the difference out of your own pocket until you resolve the issue. Insurance companies have many options to minimize or delay your insurance payout after a hurricane hits Daytona, Tampa, The Villages, or Orlando. In addition to the trauma of the hurricane, you need to fight the insurance company’s tricks too. That’s why having an insurance professional in your corner is the best option for receiving the payout you need to rebuild.

How Central Florida Property Claims Helps After a Hurricane

At Central Florida Property Claims, our team is comprised of expert public adjusters who will handle the insurance companies for you. Our team of public adjusters is on your side from the first call to the complete restoration of your property. Public adjusters are familiar with all the legal requirements and insurance company tactics related to hurricane damage. Our public adjusters handle your claim so you can focus on rebuilding rather than managing the insurance companies. When you have hurricane damage, call Central Florida Property Claims first. Our professional public adjusters can help you file your claim properly from The Villages, Tampa, Orlando, or Daytona and get the payout you need.

Types of residential and commercial damage we manage:

Types of residential and commercial damage we manage:

Frequently asked questions

What is a public adjuster?

A public adjuster is a licensed insurance processional that represents policyholders and advocated for their best interest. A public adjuster ensures the policyholder is paid the maximum amount of money possible and the insurance company makes the payment in the shortest amount of time. Whether it is a brand-new claim or an old claim that was denied or underpaid, a public adjuster will manage the claim from start to finish.

Why do I need a public adjuster?

Insurance claims are detailed and complex. To ensure you are paid the maximum dollar amount, our public adjusters will fulfill all your duties outlined in your policy, prepare all the required documents, create a detailed repair estimate, consult with expert contractors, manage all correspondence with your insurance company and much more! A study done by The Office Program Policy Analysis and Government Accountability (OPPAGA) found that policyholders that used a public adjuster received 747% more on their insurance claim than policyholder who filed on their own.

What does it cost to start?

Our fee for service is based solely on us recovering money for your claim. We do not require any money upfront, and we only get paid if you get paid! The first step to getting you paid is to give us a call today so we can schedule a time to meet with on of our public adjusters.

What are the next steps?

Free initial consultation which includes an inspection, damage assessment and policy review.

We will then schedule and attend an inspection with your insurance company’s adjuster.

Once our reports are complete, we will start negotiations to get your claim settled.

We are here to make this process simple and hassle free for you!

What are the next steps?

Free initial consultation which includes an inspection, damage assessment and policy review.

We will then schedule and attend an inspection with your insurance company’s adjuster.

Once our reports are complete, we will start negotiations to get your claim settled.

We are here to make this process simple and hassle free for you!

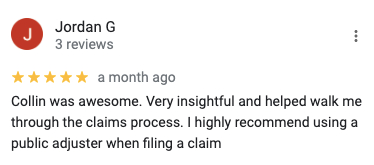

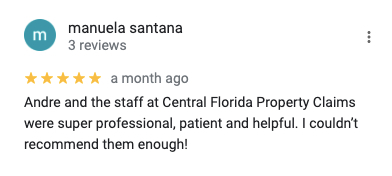

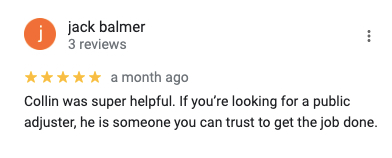

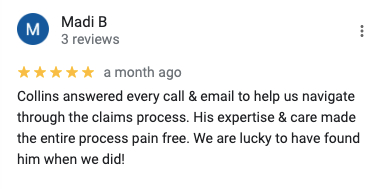

What customers say About Us

What Customers say About Us

Get A FREE Inspection Today

Get A FREE Inspection Today

©2023 by Central Florida Property Claims. Andre Kratt Lic. #W636283

©2023 by Central Florida Property Claims.

Andre Kratt Lic. #W636283